It's About to Get Ugly for $CVNA

A deep dive on the Carvana short thesis

Intro

Carvana represents one of the most asymmetric short setups in the market today. There are variety of reasons which are all converging to make the probabilities of it having a severe drop very likely.

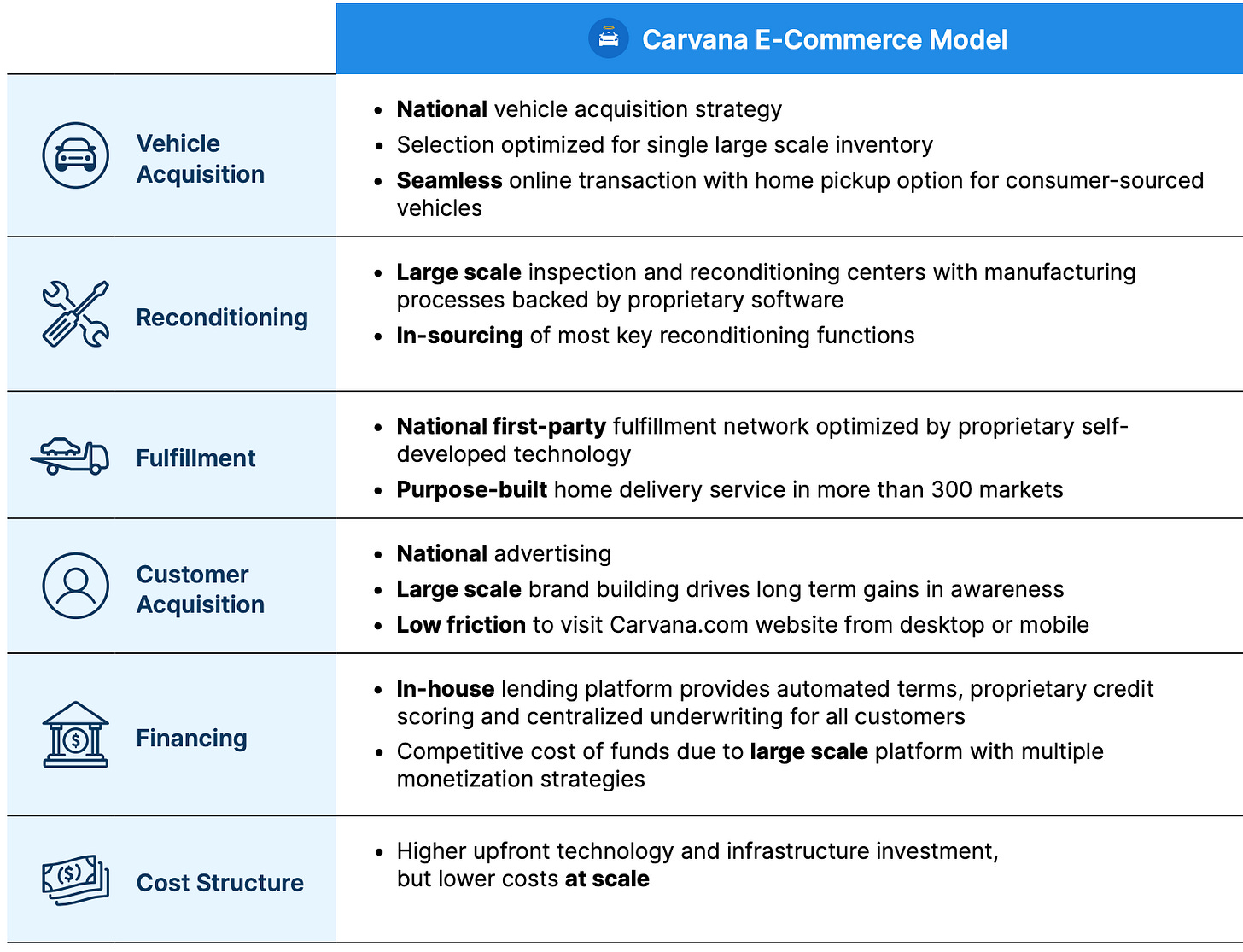

Before I dive in to the short thesis, I think it is important to lay out that I actually like what Carvana is doing. They are an innovative company and are doing a lot of cool things to tackle an extremely difficult problem in making an e-commerce car buying model a great experience for consumers.

While I do like what they are doing, the reality of it is, they are a subprime loan machine disguised as a car retailer (more on this later).

Macro Context

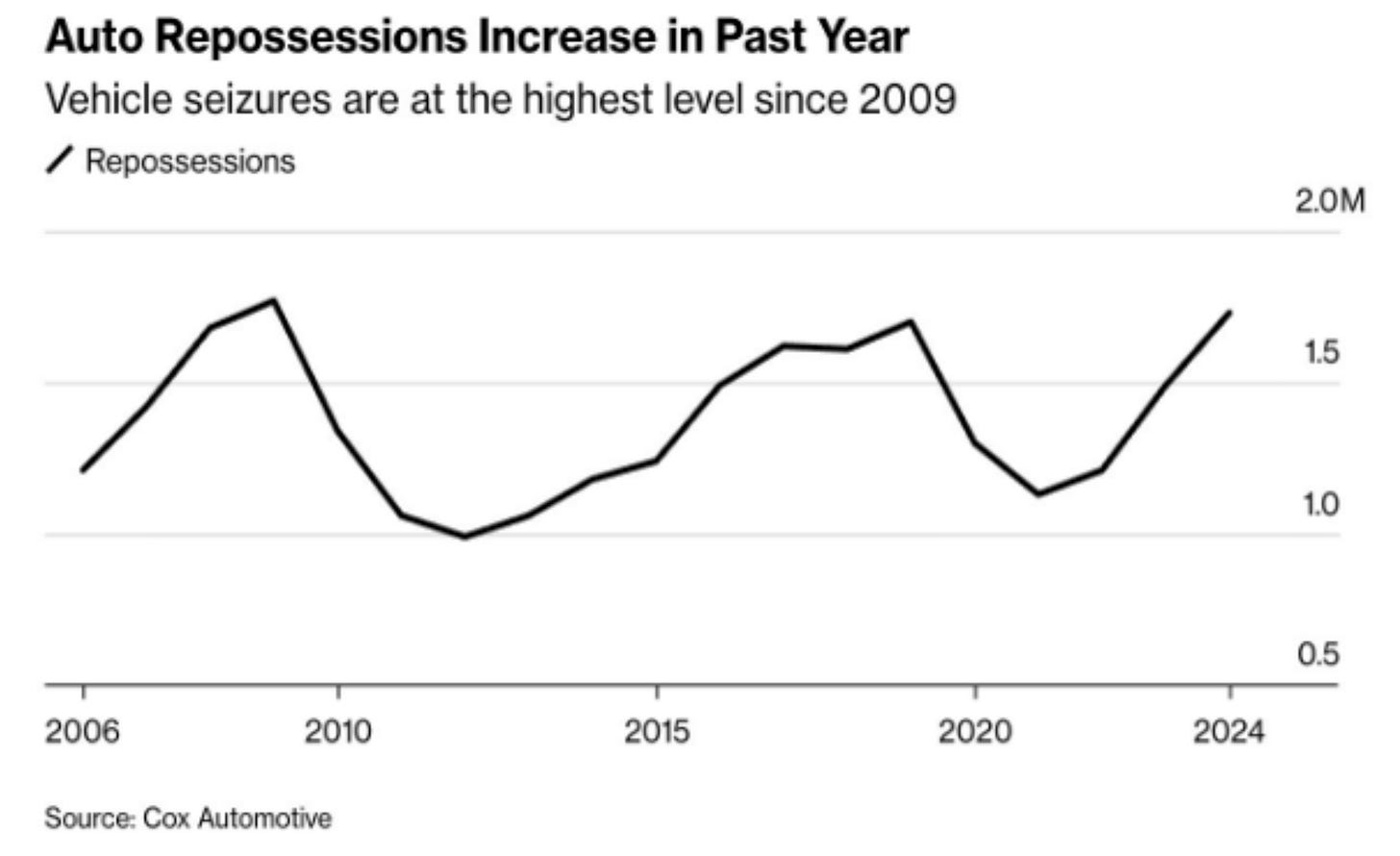

The current macro environment is critical to understanding the risks facing Carvana. Stress in the subprime auto loan market is rising rapidly.

Subprime auto delinquencies are at all-time highs.

Auto repossessions are at the highest level since 2009

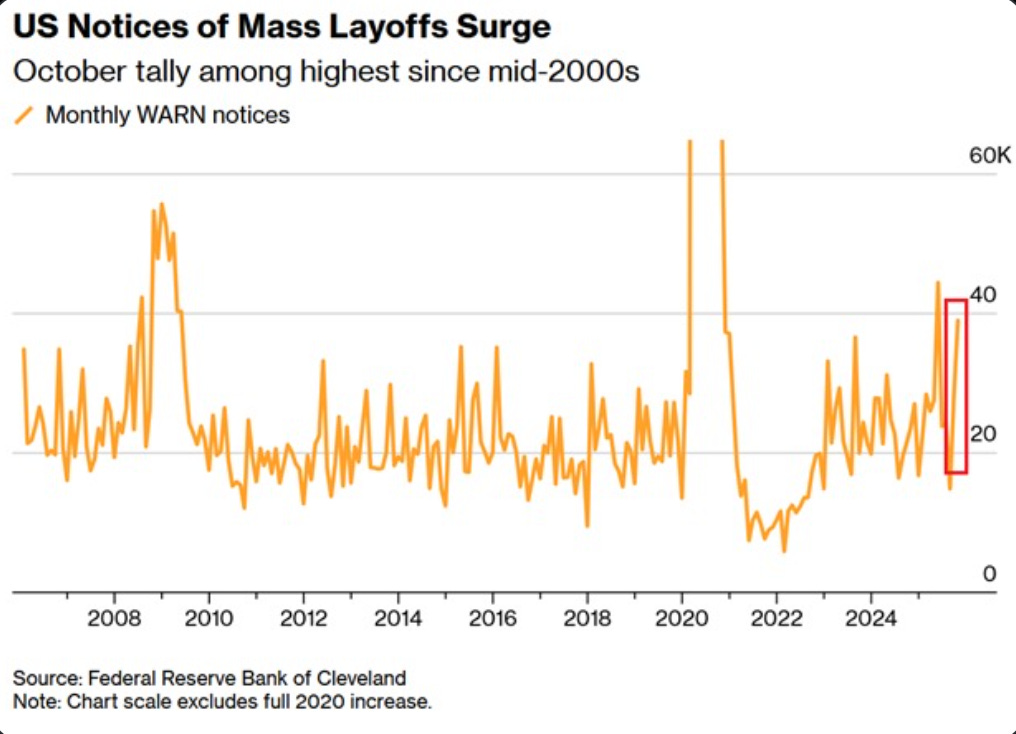

The labor market is also in a tough spot. Unemployment continues to trend higher with no signs of stabilizing, and announced layoffs have spiked meaningfully. This combination is not good for the auto industry.

Valuation & Carvana’s Profitability

At the time of writing:

Carvana: 3.96 P/S, 74 P/E, 132 P/FCF

CarMax: 0.20 P/S, 10.22 P/E, 7 P/FCF

CarMax is down ~56% YTD as it struggles through a difficult auto retail environment.

So why hasn’t Carvana sold off the same way?

Two reasons:

Passive flows artificially supporting the stock (explained later)

Higher reported gross margins (20% vs. CarMax’s 10%)

But it’s critical to understand why those margins are higher.

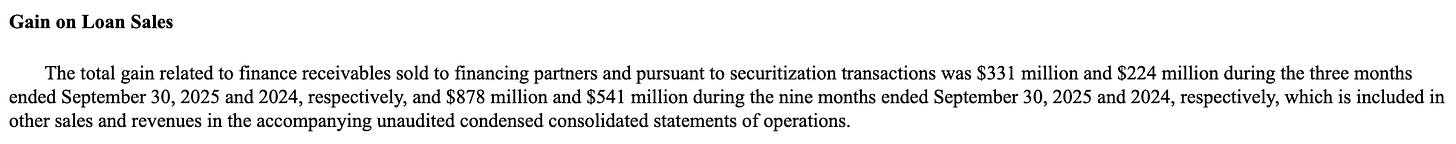

They frame it to look like it is because they have done all this infrastructure investment, have better processes, etc. And while that may be true, the reality is that they achieve this margin from selling subprime loans. A large portion of profit comes from “Gain on Loan Sales”

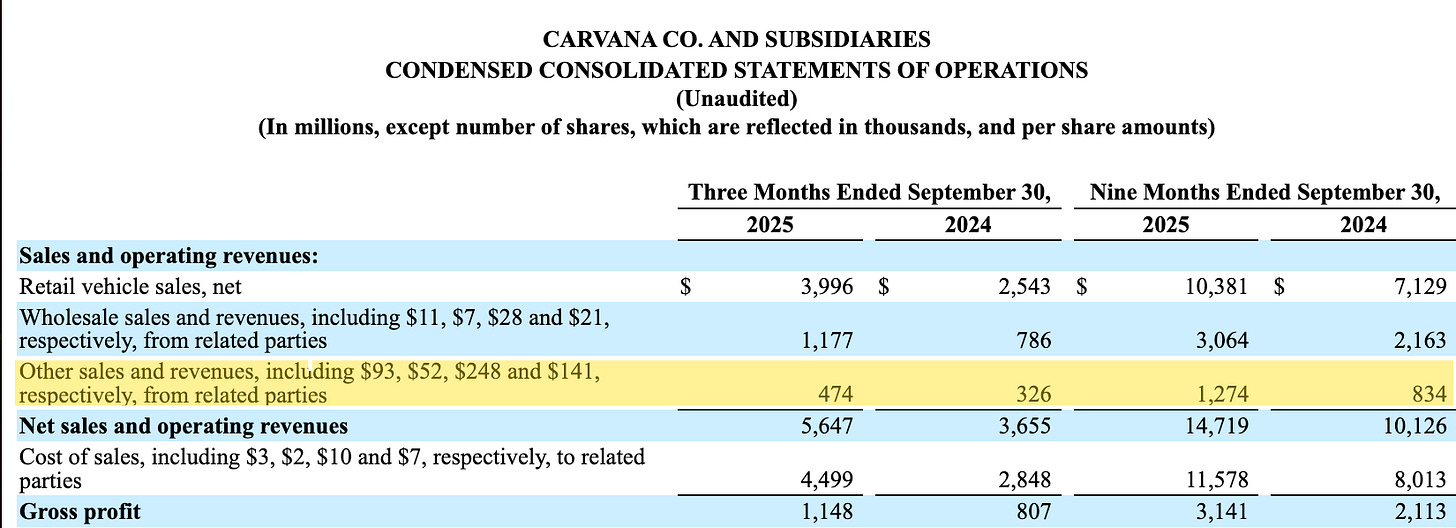

This “Gain on Loan Sales” hits the “Other sales and revenues” line which significantly contributes to achieving that gross margin. $1.21 Billion dollars of profit YTD came from loan sales.

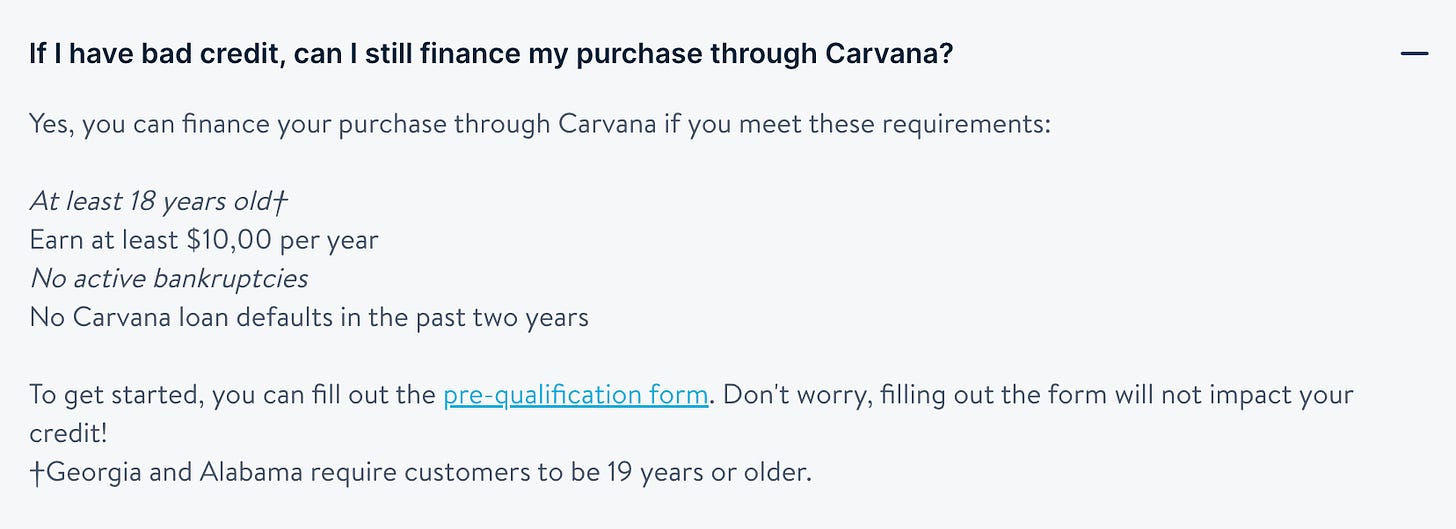

I took this screenshot from their website to show you what you need to qualify for the loans they sell (they recently raised this from $4k annual income). That tells you everything to know.

When the Music Stops

Carvana’s entire model depends on originating subprime loans and selling them either to banks, credit funds, or through securitizations.

So what happens if banks stop buying?

Carvana would be forced to hold the loans it originates.

This is catastrophic because:

Carvana doesn’t have the capital

The balance sheet is already strained

Holding loans drains liquidity

Losses rise as delinquencies increase

Mark-to-market hits compound rapidly

If the securitization market stalls, Carvana:

Cannot recycle capital

Cannot offload credit risk

Must drastically slow retail sales

This is exactly what happened to subprime lenders during the 2008 mortgage collapse and again during the 2015 subprime auto tightening.

Worst-case: Liquidity crisis → Bankruptcy risk

This is not hypothetical. It almost happened in 2022–2023.

Carvana only survived because:

Borrowers accepted extremely high loan rates

Investors bought securitizations again

Used car prices rose

Credit markets reopened

If banks step away again, especially in a recession, Carvana could face existential pressure.

Credit Tightening

How likely is it that banks cut back on buying these loans soon? In my opinion, very likely.

Just recently, we have seen multiple subprime auto lenders face issues, One of them being PrimaLend who entered bankruptcy just a month ago.

Tricolor, a major subprime auto lender recently went bankrupt as well. What triggered this was JP Morgan cutting it’s credit to them. Tricolor was forced to halt loan originations, cut off dealers, and move into liquidity survival mode.

This is exactly the kind of dependency CVNA has.

JP Morgan CEO Jamie Dimon was recently quoted saying:

“When you see one cockroach, there are probably more. And so everyone should be forewarned on this one”

Dimon’s warning is a signal to investors and the broader market to be cautious and prepared for potential further defaults or credit issues, especially if the economy were to weaken.

If more issues begin to arise, and the data does not improve soon, buyers for Carvana’s subprime loans will dry up.

Institutional Ownership

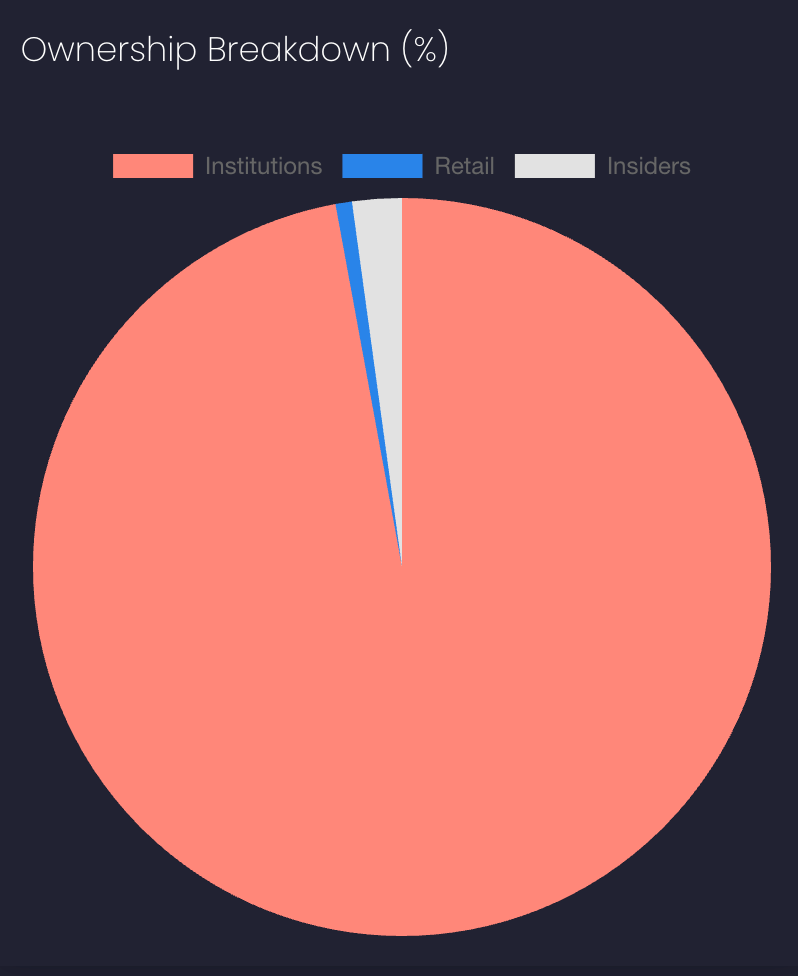

Carvana’s ownership breakdown is key to this story. About 98% of the float is owned by institutions.

The top 4 holders of the float are passive institutions (about 21%). This is why Carvana stock has held up well because of the strength in the broader market. Passive flows into these funds have contributed to keeping the stock elevated and at a high valuation.

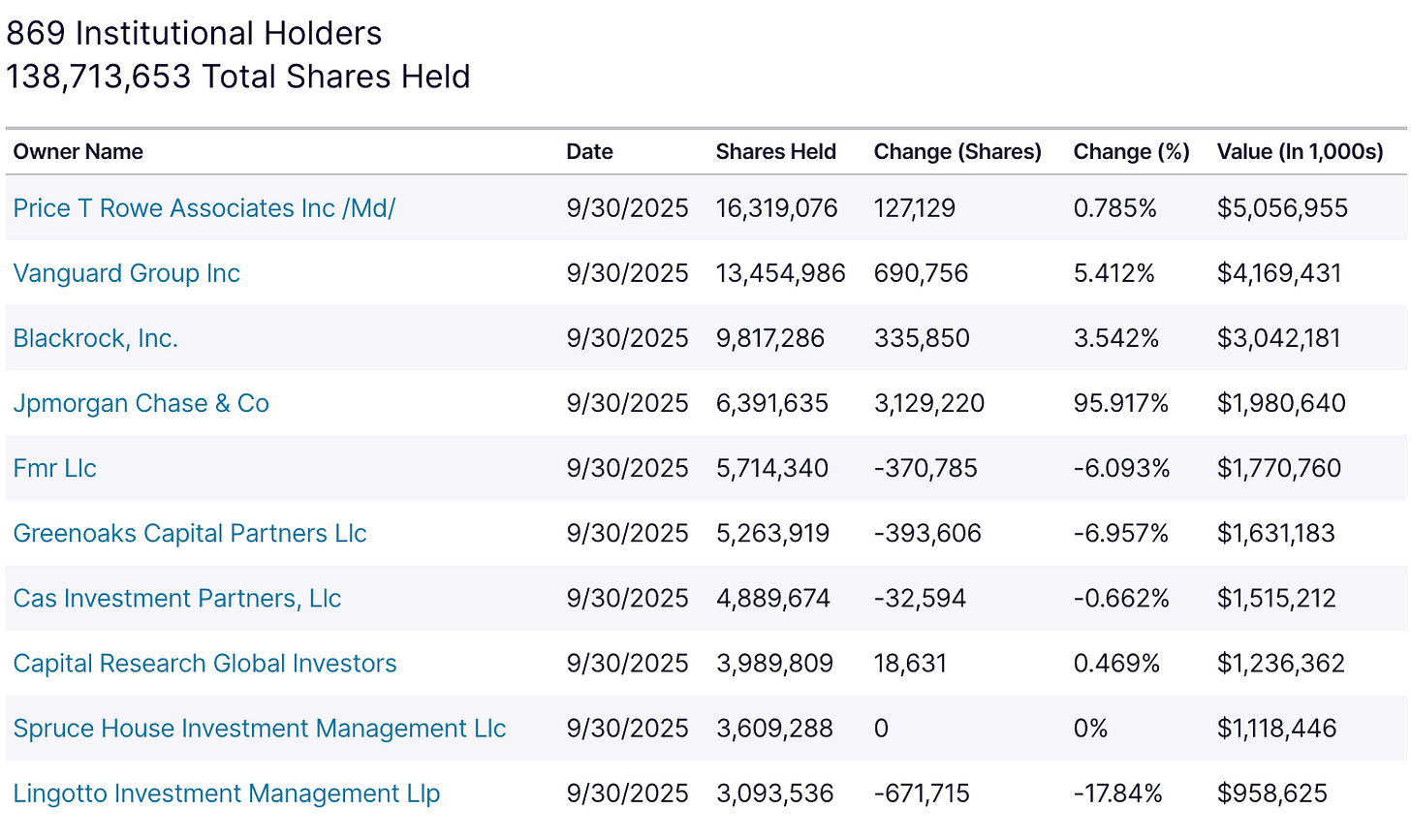

The next 3 largest holders who are the largest active funds are FMR, Greenoaks Capital, and Cas Investment Partners. These institutions key to the thesis because they own such a large % of the company. As you can not only are they selling, but the other active institutions have been as well.

Because they are the largest active holders of the company. They would be first to act in anticipation of a credit event.

Looking at CAS and Greenoaks, they are both heavily concentrated in the stock. Carvana makes up 82.26% and 64.77% of their portfolios respectively. They have both been selling the stock, which may seem like normal profit taking on a large position, but they are forced to have minor trims. If they sold a large portion of their position, because the float is so limited, there would be no natural buyers to absorb the supply and the stock would fall sharply.

Cliff Sosin (CAS Investment Partners)

If you don’t know who this is, this is Cliff Sosin (CAS Investment Partners). He is known for having this legendary trade on Carvana, buying near the lows at when he bought it was when the stock was priced for bankrupcy and ended up with an incredible gain on the position.

When doing research for this article I discovered two podcasts he went on and discovered a lot about Carvana and Cliff.

First of all, I just want to say Cliff is a legend for this trade, and seems like an extremely intelligent guy and is very likable.

This is why he is key to this story. In the podcasts he mentions multiple times that the biggest issues in his journey with Carvana was macro forces which were out of his control. He has experience with macro making Carvana’s business extremely tough and is very knowledgable about the financing part of Carvana’s business.

After watching these podcasts, it would be highly unlikely that Cliff is not aware of the macro and credit risks I highlighted earlier on in the article. The fact of the matter though is that he is stuck. He has been lightly trimming his position, because if he unloads a large portion of the position, he will tank the stock price, not only because of the size of his position in the company & the float, but also because he is the face of the turnaround story.

It will be very interesting to watch what Cliff does with CAS Investment Partners’ position in the company.

Fraud?

It is important to note that there have been multiple accusations of fraud. This is not the point of the article but is important to note that if fraud ends up being discovered, this would obviously also tank the stock.

There is currently a class action lawsuit against Carvana which is moving forward in court.

Conclusion

The macro reasons and valuation alone is enough of a reason to be bearish on the stock alone. The data of subprime delinquencies and subprime lenders going bankrupt all point to a credit event happening soon. It is very likely that banks stop or at least slow the purchasing of these loans which would be a catastrophe for the company and the float which is largely held by hedge funds seems like it is a game of musical chairs now.

This is why I am short the company as I believe the stock has a high probability of unwinding soon and is great hedge to macro deterioration.

Would love to hear your thoughts. Think I got something wrong or missed something? Let me know!

Just like Jim Chanos said "Carvana isn't in the business of selling cars- they are a seller of deep Subprime shit"

And after Tricolor and the rest I ask myself "what kind of a Financial Institution with common sense buys Carvanas crap credits??"

And if they refuse- Carvana screetches to a halt and can't do any business.

They do "fog a mirror loans" where every bum can get a carloan no matter of their credit standards😂

2008 Subprime all over again.

Very impressive analysis.