The Most Misunderstood Company in the Market: $UPWK

Understanding the $UPWK Bull Thesis

Intro

I’ve been talking about Upwork (UPWK) on X since the stock was around $12. At the time, I viewed it as an attractive risk/reward opportunity, though the ultimate upside still carried some uncertainty.

Since then, Upwork has reported earnings and hosted its first ever Investor Day. Both of these have only reinforced my original thesis and made me even more bullish on the company.

For those unfamiliar, Upwork is a freelancer marketplace that connects businesses with independent professionals for short-term, long-term, or project-based work. If you’re starting a business today, Upwork is the place to source high quality talent. Over time, the company has expanded beyond its original use case and is positioning itself as a broader solution for how work gets done.

Peter Lynch - Invest in What You Know

One of Peter Lynch’s core investing philosophies was to invest in what you know and that there is alpha in understanding companies whose products you personally use. That mindset is what got me to look into Upwork and allowed me to understand the bull case early.

For context, I started a company that I likely would not have attempted without the assistance of AI. AI dramatically lowers the barrier to entry for entrepreneurs, allowing individuals to overcome obstacles that previously would have stopped many people from even starting.

When I went searching for serious talent to build a real product, I explored every platform I could. None came close to Upwork in terms of talent quality, depth of the talent pool, or the ability to vet candidates before even interviewing them, through portfolios, historical earnings, and verified client feedback.

Upwork takes a fee from both the client and the freelancer. I often asked freelancers whether they would prefer to get paid off-platform to avoid fees. Almost every time, the answer was no.

Getting paid on-platform builds verified earnings history and credibility, which directly increases a freelancer’s ability to win future work. That feedback alone demonstrated just how sticky Upwork’s ecosystem is.

Interestingly, I did hear some complaints about fee increases through the shift from variable to fixed fees. When I asked why they didn’t leave, the answer was simple: there is no better alternative. While that may not be ideal from a user perspective, from an investor’s standpoint it showed how sticky their business is.

Macro Economy/AI

Upwork was sold off to extremely cheap levels. When I initially bought the stock, it was trading at roughly 8x earnings and under 9x free cash flow. Given the company’s fundamentals, this valuation was shocking.

The selloff was driven entirely by a narrative which was the belief that AI would eliminate the need for freelancers and render Upwork’s business obsolete.

That narrative didn’t made sense to me. While it’s true that AI may reduce demand for certain types of work, it simultaneously creates demand elsewhere and lowers the barrier for more people to start businesses.

In my view, AI is not a threat to Upwork, it is a tailwind. As the labor market continues to weaken and people become unemployed, they will either turn to freelancing or attempt to build businesses of their own, which increases demand for Upwork’s services.

This is already showing up in the data. There has been work that seems to have been replaced by AI, but there is also surging growth for AI related work on the platform.

Valuation

At the time of writing, UPWK is trading at approximately 3.6x sales, 11x earnings, and 15x free cash flow.

Given the company’s margin profile, balance sheet, and growth opportunities, the current valuation is very still attractive.

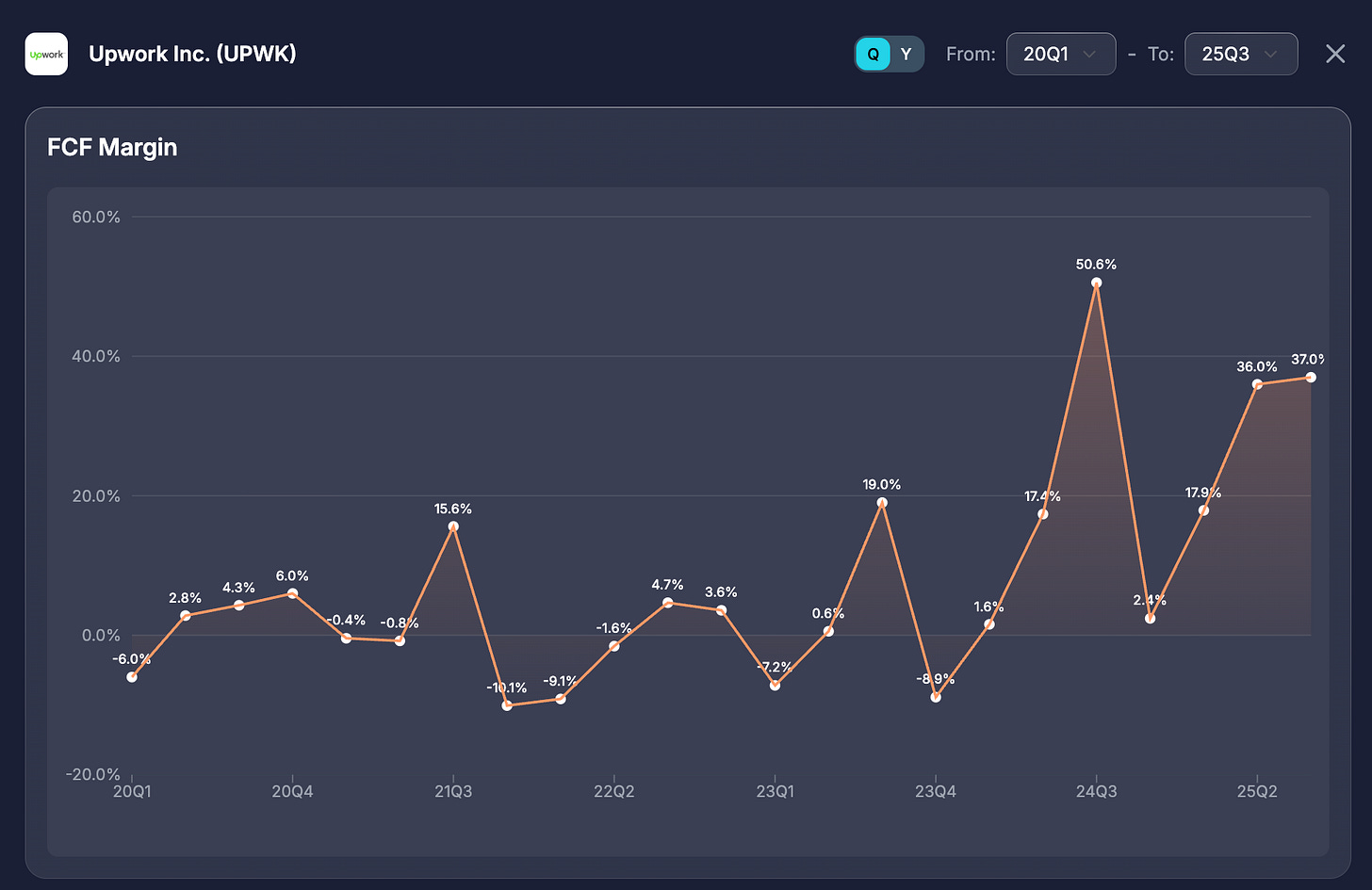

Margin & Cash Flow

Upwork has shown consistent margin improvement and is now in a position to generate significant free cash flow. The company currently operates at approximately a 24% free cash flow margin.

Management has guided for continued margin expansion over the next several years, though near-term margin growth may temporarily stall as the company invests in its enterprise offering to reaccelerate top-line growth.

Now that UPWK has become a cash generating machine, they are executing share buybacks and will continue to do so as they grow.

Upwork has completed its acquisition phase, having recently acquired Bubty and Ascen to support its enterprise strategy to fuel the next phase of growth.

With those investments behind them, management has made it clear that excess cash flow will be directed toward share repurchases, while still retaining flexibility to invest opportunistically.

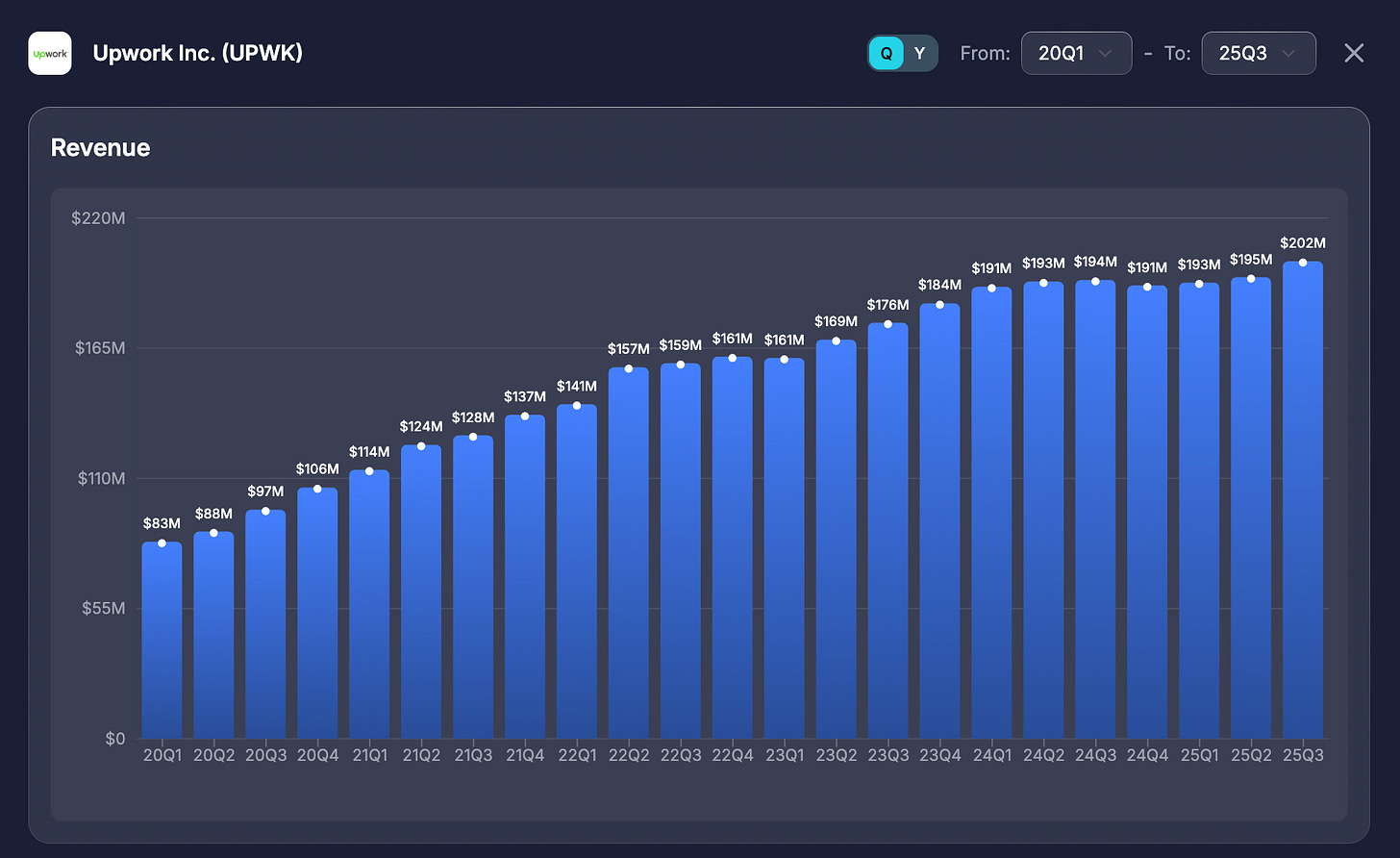

Revenue

Before the most recent quarter, revenue growth started to stall. This is where the bear case was formed. The market sold it off to ridiculously cheap levels and the narrative formed where “AI kills the need for freelancers and their business is dead”. My thesis was that the market was completely wrong on this and AI is actually great for their business.

This past quarter, revenue and GSV showed some growth again, showing that my original thesis is correct. Top line re-acceleration begun, in the middle of a struggling labor market and the narrative has started to fade away, hence the run-up in stock price.

Enterprise (The Big Growth Driver)

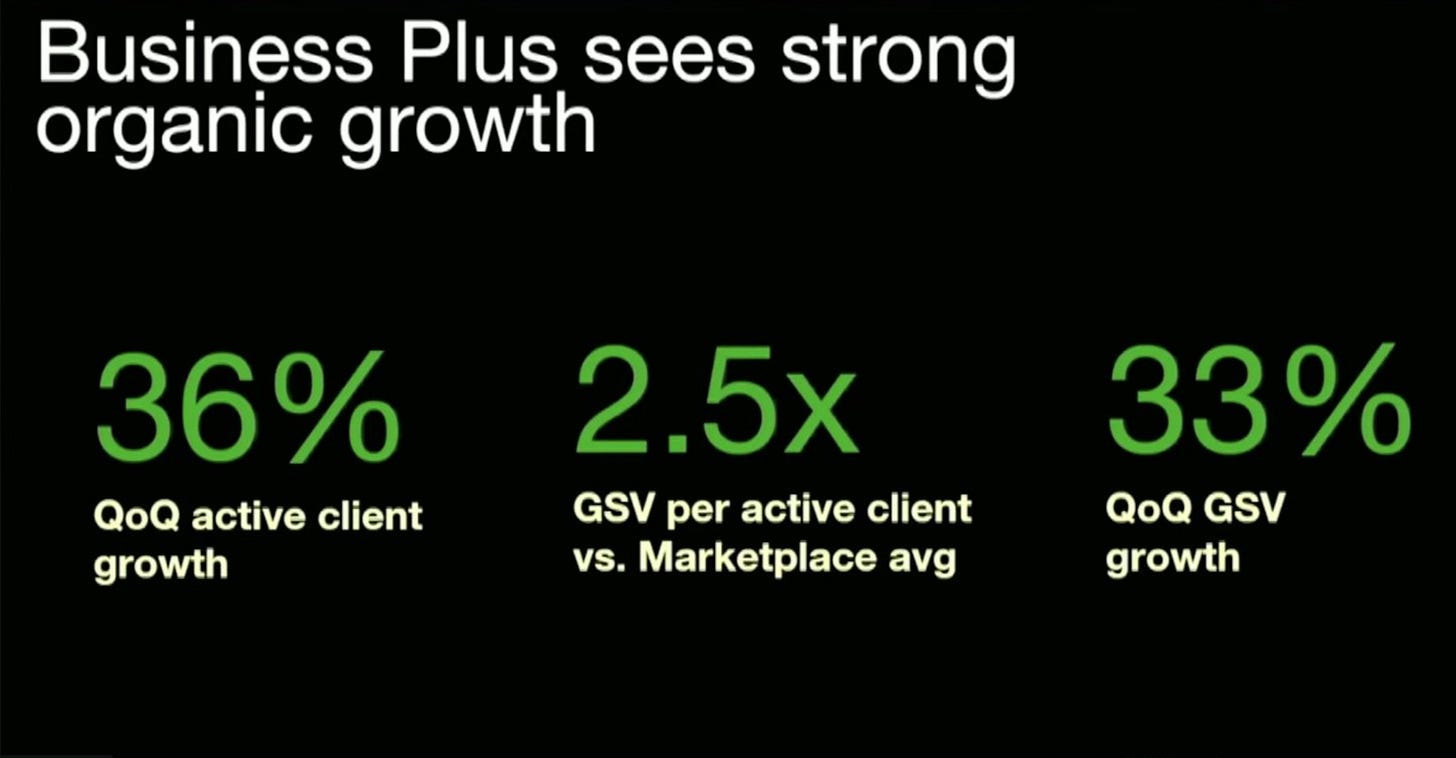

UPWK has a separate product from their freelancer marketplace tailored for enterprise customers called “Business Plus”. This product has seen strong growth, due to the trend of work becoming more fractionalized. If a company needs highly skilled talent for a specific job, they can source and hire them through Business Plus.

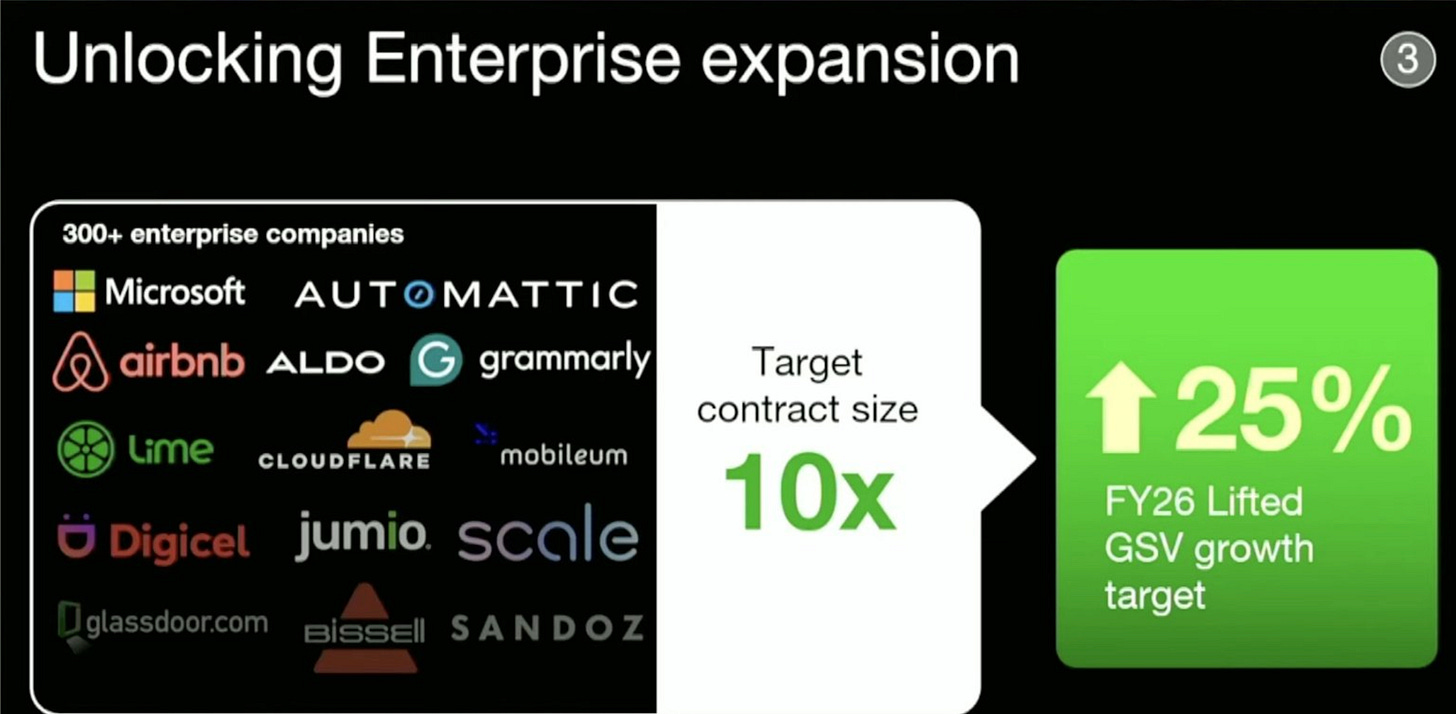

Business Plus is already seeing strong growth in this environment and is used by many well known companies such as Microsoft, Airbnb, Cloudflare, and more. Although it is looking strong, the real growth comes next year, when their new and improved enterprise platform releases.

Earlier this year, Upwork acquired Bubty and Ascen. These businesses are being fully integrated into Upwork’s platform, augmenting its existing infrastructure and allowing the company to deliver a more comprehensive, higher-value product for enterprises. This product is called “Lifted”.

The way they described it, is that they have the demand and relationships from large enterprises, but there was a gap that they couldn’t fill before which they unlocked through these acquisitions. This allows them to achieve bigger contracts with existing clients, and now serve new clients which they couldn’t before.

Lifted releases next year and will be a massive driver for UPWK’s growth.

Share Buybacks

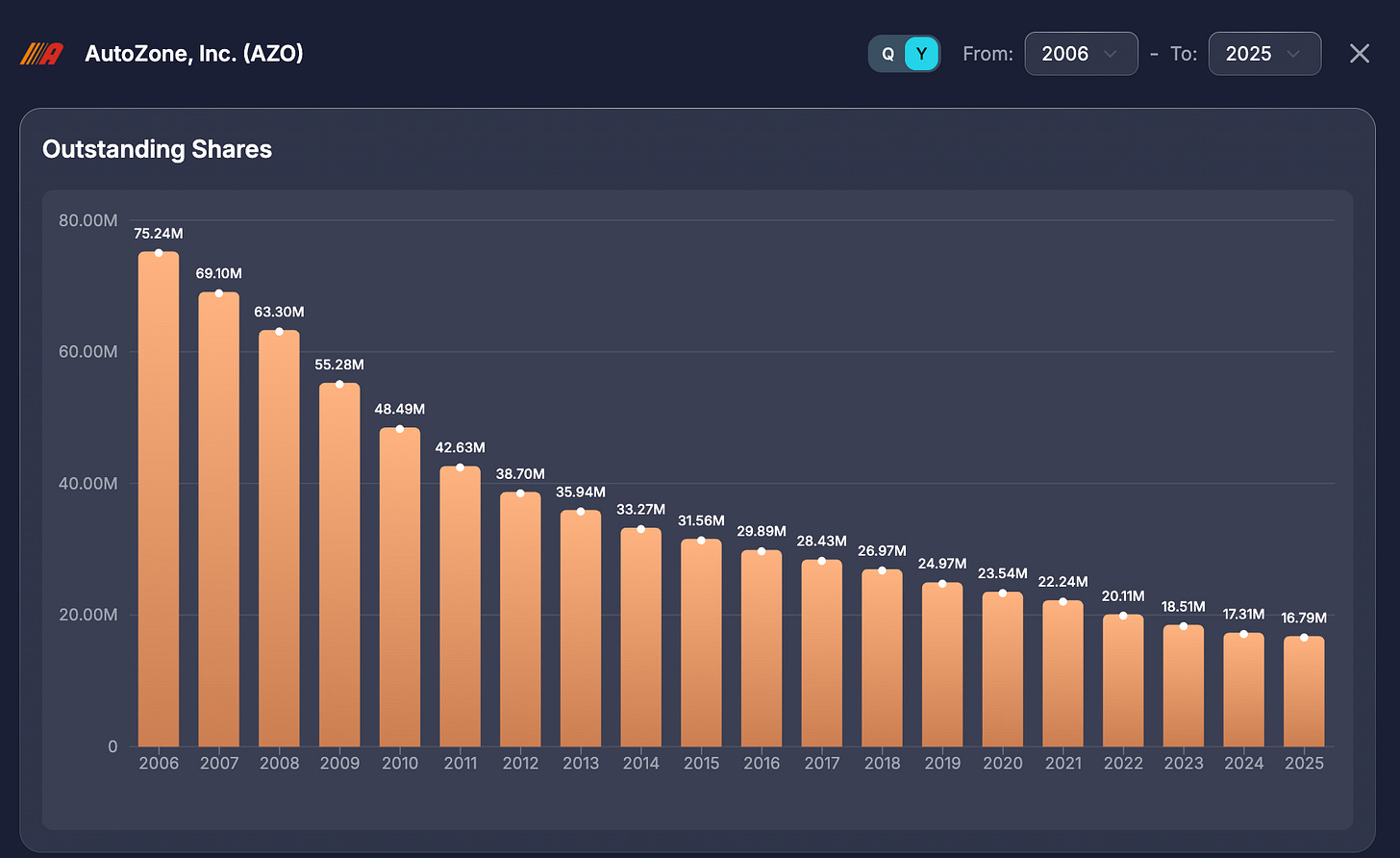

Take a look at this stock chart. This stock went from around $84 to $3500 in 16 years. 41x returns.

You would think that this is some crazy innovative tech company, but it’s not. It’s Autozone, a damn auto parts retailer.

The reason they had this insane run, is because they consistently produced cash flow and returned capital to shareholders through buybacks.

This is a chart of AutoZone’s outstanding shares. AZO is the perfect case study for the power of share buybacks. Not a sexy company by any means but it’s the perfect example of a cash flowing business growing profitably and consistently buying back shares.

I believe UPWK is in a similar, if not better position than AutoZone in the early days.

UPWK already completed 2 acquisitions to fuel it’s growth for the next 3 years and beyond. Its balance sheet is also rock solid. Now, and for the foreseeable future, they are positioned to grow profitably and buy back shares as they grow.

I did some simple math for fun just to show you something crazy:

UPWK is estimated to generate around $200M of OCF this year.

If they only grow operating cash flow by 10% a year, in 3 years they would have generated $728M of cash which can be allocated to buy backs

The company is currently $2.87B. That gives them the ability to buy back 25% of the company at these levels. Of course stock based compensation is a factor too but you get the point.

Investor Day

As I mentioned earlier, since I initiated my position, Upwork has reported earnings and hosted its first ever Investor Day. Both events reinforced my thesis, particularly around AI, but more importantly highlighted the scale of the opportunity ahead with Lifted.

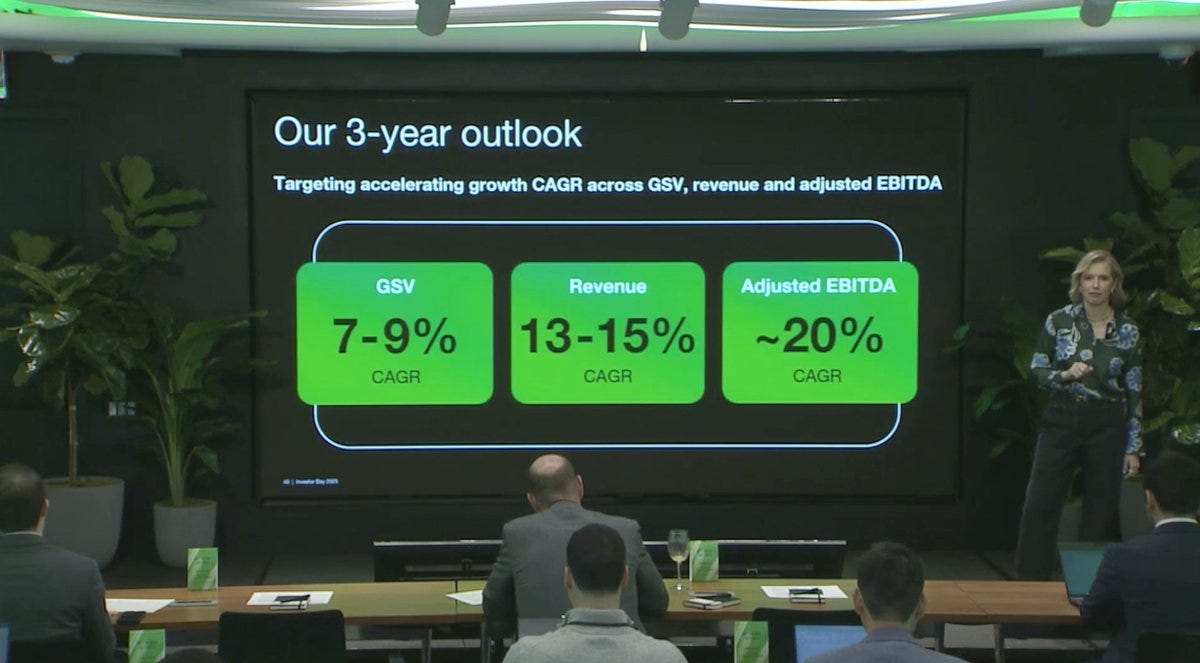

Investor Day demonstrated a high level of confidence from management. The company laid out clear three-year targets, including 13–15% Revenue CAGR and 20% Adjusted EBITDA CAGR. Upwork had never hosted an Investor Day before, and management explicitly framed this as a reflection of their confidence in the business and visibility into the next phase of growth.

Since Investor Day and recent earnings, the bearish narrative around Upwork has begun to fade. As the market has started to reassess what the business actually is, rather than what it was assumed to be. The stock has responded accordingly.

Competition

Fiverr (FVRR) is Upwork’s only true competitor and is a name I’m frequently asked about.

Having used both platforms, I believe Upwork operates in a different tier. The deepest, most serious talent is on Upwork, not Fiverr. This distinction matters, especially in the context of AI.

The AI disruption narrative is far more applicable to Fiverr’s marketplace, which is heavily skewed toward one-off, commoditized tasks such as logo design, which is much more disruptable by AI. Upwork, on the other hand is focused on complex, ongoing, and high-skill work where AI acts as an augmenting tool rather than a replacement.

Since I purchased Upwork, the divergence has become clear: Fiverr shares are roughly flat, while Upwork is up approximately 70%. The market is beginning to recognize that these businesses are not the same.

Additionally, Upwork’s enterprise offering is meaningfully ahead of Fiverr’s. Large organizations are already trusting Upwork with hiring needs, and this advantage should widen further with the launch of Lifted.

To be fair, Fiverr could still be a great investment. It trades at a low valuation and generates cash flow, which gives them the ability ability to buy back shares over time. However, I view its long-term business risk as higher.

If anything, both companies can win, but FVRR is not going to stop UPWK from being successful.

Other

There are a few additional elements of Upwork’s business worth mentioning, though I view these as a “cherry on top” rather than core to the thesis.

Upwork has introduced AI-driven features under the “Uma” brand, which help clients source talent, take meeting notes, conduct interviews, streamline workflows, and more. While these features are interesting and potentially useful, I do not assign meaningful value to them in my bull case.

The company has also begun monetizing advertising, allowing freelancers to promote their profiles and clients to boost job postings. This represents another potential revenue lever, but again, it is not central to the long-term thesis.

Conclusion

A company that was widely considered “dead” just months ago is now positioned extremely well to benefit from long-term shifts in employment, entrepreneurship, and AI-driven productivity.

Upwork’s core marketplace continues to demonstrate strong fundamentals, while its enterprise platform represents a major growth catalyst. Lifted is designed to capitalize on the increasing fractionalization of work and should meaningfully contribute to top-line re-acceleration.

With free cash flow margins now around 24%, Upwork has reached a point where it can consistently generate significant cash and return capital to shareholders. As free cash flow grows and shares outstanding decline, free cash flow per share will compound at an accelerating rate.

At the end of the day, FCF/share is what matters. That is the cash that belongs to you as a shareholder.

It is important to note that management said that meaningful top line re-acceleration will not begin until the back half of 2026. This means there could be a stagnation in stock price for a bit, but that will just be an opportunity to accumulate more.

Price Target

Because people love price targets, here is my back of the napkin 2028 price target using FCF/share:

In my bull case, I believe UPWK can achieve 50% FCF/share driven by cash flow growth, and substantial share repurchases.

2028 FCF per share (50% CAGR): $5.10

Valuation at 15x FCF: $76.50 per share

Current price: $18

This results in a 4.25x return in 3 years.

Even if Upwork falls short of this and compounds FCF per share at closer to 30%, which I view as very achievable, the stock will still perform well and is great risk/reward.